Introduction:

At any point in time, one has to liquidate the crypto tokens or coins accumulated in a crypto wallet. The process of converting a cryptocurrency to a usable fiat currency may draw in more legal entities in the asset conversion process, and also introduce a crypto tax for each transaction based on the user’s geography which is inevitable. But, for those users looking at each cryptocurrency from a utility perspective, there are broadly two different service providers catering to their needs. Let’s discuss each in the upcoming sections.

What is a Centralized Exchange (CEX) ?:

It is similar to the stock market exchanges where users have to add funds to their wallet or deposit them to a third party and then invest or trade on the assets, here cryptocurrencies. CEX works in tandem with the existing financial systems to facilitate the onboarding of new-age crypto investors where users convert their fiat currency to a cryptocurrency. It maintains an order book, to record and validate each transaction. The transaction data is stored on servers owned by the exchange company. This implies that their identity is compromised to facilitate KYC (Know your customer) protocols. Such protocols exist in traditional banks and CEX in order to protect users from fraudulent transactions/ accidental transactions or money laundering cases.

Another crucial aspect is that the price of cryptocurrencies is based on the order book maintained by CEX, and the trade data isn’t stored on any blockchain network.

If you’ve read so far, you would feel that CEX is not a worthy option for crypto trading. But, hold on let me simplify further why it’s a viable option for many.

Why should I rely on CEX ?:

- Easy for beginners - CEX is more beginner friendly when it comes to setting up a crypto wallet and transacting with funds.

- The high liquidity volume of CEX ensures that the conversion of cryptocurrency from one coin to another is more likely to happen.

- Large-scale transactions help maintain a lower transaction cost.

- The speed of transaction is always greater than DEX as the servers are centralized and fetching data is quicker.

- Allows the purchase of cryptocurrency using fiat currency.

- Listing of new coins becomes easier in the case of CEX.

Can I really trust CEX ?:

- The fundamental core aspect of cryptocurrency is anonymity, which is completely compromised while using CEX.

- Another philosophical drift would be the centralization aspect of sensitive user data within the company servers.

- Trusting the exchange would be risky in times of market crash.

- They have a trading fee for each transaction.

Decentralized Exchange (DEX):

Just like traditional exchanges, Decentralized Exchanges often termed as (DEX) in the crypto community are gaining traction over Centralized Exchanges. The reason behind being the fact that the central authority/ third party required for a transaction is replaced by a smart contract, which is a self-executing legal agreement designed by code running on a blockchain network. The order book which maintains the price data for each coin is stored either onchain or off-chain, leading to the speed of transaction difference between different DEXs. The P2P architecture makes it a viable anonymous mode of crypto transactions. There are two broadly classified DEX -

Automated Market Makers:

It is an algorithm used by most DEX players. This exchange protocol relies on smart contracts to adjust the price of tokens and maintain the liquidity pool. These liquidity pools ensure the market is stable. It doesn’t require trading pairs to proceed forward with the transaction. One such example is Uniswap, where the always-on and permissionless liquidity enables the building of robust web3 applications. Liquidity providers who put their tokens at stake, earn a passive interest from the trading fees.

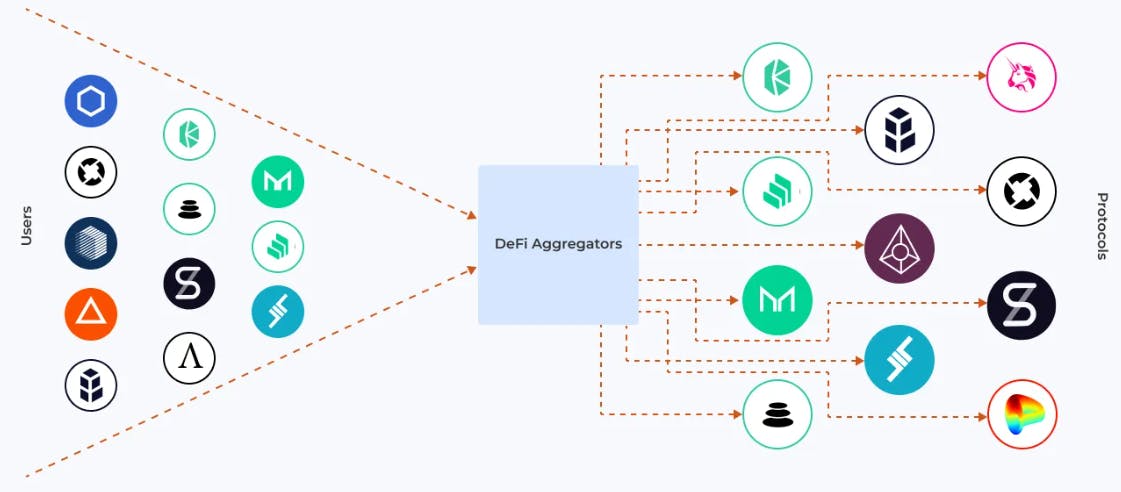

DEX Aggregators:

The price of tokens keeps fluctuating in a DEX at any point in time. The varying prices of tokens on numerous DEXs make it tough for crypto enthusiasts to choose one DEX over the other. Aggregators use complicated algorithms coupled with numerous other factors and provide the best possible exchange for a given token swap. They assist users in making informed decisions about token swaps. A simple analogy to this would be the sort items by price option on any online shopping app which arranges items in ascending order with respect to the price.

What makes DEX special ?:

- KYC information is not needed.

- No centralized authority implies that users have to trust an open-source code accessible to anyone to audit.

- Much faster than CEX as the user base increases.

- Support all kinds of hot wallets.

- Community support is great for seasoned developers.

Should I really use DEX ?:

- They are at a nascent stage. Code is open for anyone which is a double-edged sword.

- Slower operation as every order, alteration and cancellation is handled within the blockchain.

- Must use a Hot Storage Device (wallet connected to the internet)

- Only allows swapping between crypto tokens

- The transaction cannot be reversed as there’s no involvement of any central authority.

- Any vulnerability in smart contracts has the potential to exploit all the funds.

- The trading fee on DEX is expensive compared to CEX.

- Auditing gets tedious with complex DEX.

To summarize both technologies are great tools to manage crypto tokens. The ideal audience for each exchange differs on the use case, philosophy and security. It is always better to experience both exchanges and experiment with tiny amounts before proceeding with bulk transactions.

Happy Reading!